Change creates opportunity.

The largest changes create the largest opportunities.

African markets today are some of the most dynamic, rapidly changing in the world due to a confluence of profound, long-term shifts that are reshaping the continent and its relation to the world.

These mega-trends include:

- Africa’s ongoing youthquake and population boom

- Unprecedented urbanization

- Rapid advancements in connectivity

- Increased emphasis on intracontinental cooperation and integration amidst growing geopolitical competition

- Rising climate change vulnerability and frequency of extreme weather events

- Expanding socio-political instability and unrest

Collisions and feedback loops between and among these megatrends are turbocharging both the speed and pervasiveness of change across Africa, creating a variety of opportunities for investors and innovators.

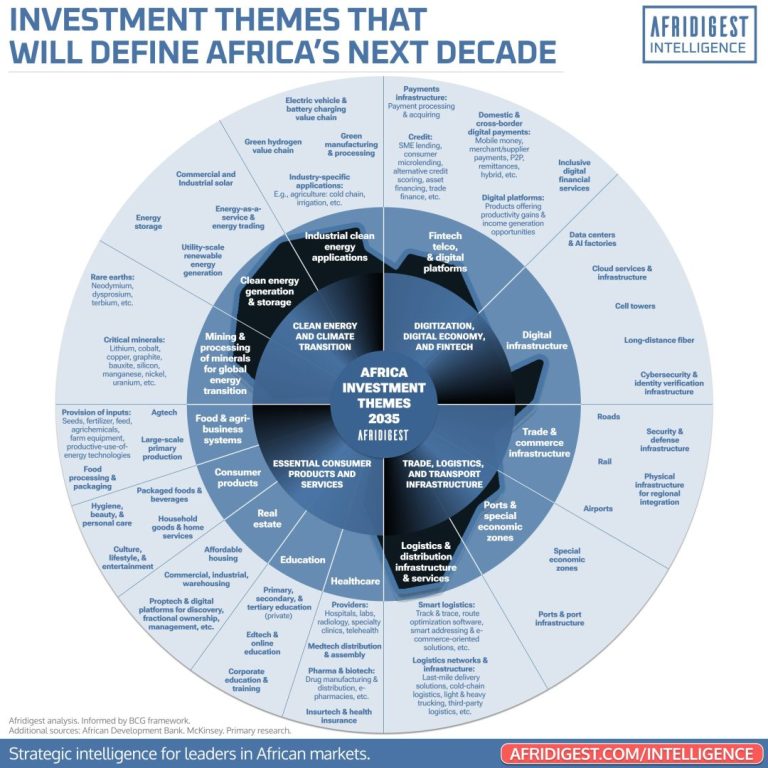

Given these mega-trends and their consequences, here are the investment themes likely to define Africa over the next decade:

- Digitization, digital economy, and fintech — The continent is still in the early stages of a digital supercycle that will touch every sphere of economic activity, presenting generational investment opportunities and the potential for immense productivity gains.

- Trade, logistics, and transport infrastructure — An increased emphasis on regional integration, export competitiveness, and interconnectedness between Africa and the world is creating significant opportunities for infrastructure development projects and solutions.

- Essential consumer products and services — The continent’s population boom and rapid urbanization continue to create prime opportunities in healthcare, agribusiness, education, real estate, and consumer goods.

- Clean energy and climate transition — With abundant natural resources including wind, solar, critical minerals, and forests, coupled with growing energy needs, Africa is well-positioned to become a global hub for clean energy generation and the global decarbonization agenda.

While these themes represent some of the highest-potential opportunities across the continent, different themes will play out differently — both in terms of where and when they’ll hit inflection points.

Understanding which markets lead in which themes and overarching timing considerations is critical for informed investing on the continent.

Share: